When it comes to protecting your home and belongings, understanding what does flood insurance cover is essential. In regions where floods can occur unexpectedly, securing flood insurance ensures that you are not left out in the cold should disaster strike. Floods can cause extensive damage to not just the structure of homes but also to the personal possessions within. This is where the importance of flood insurance becomes undeniable, offering a safety net that can help you recover without bearing the overwhelming costs alone.

NIA Home recognizes the significance of having comprehensive flood insurance. In an era where climate change and unexpected weather patterns are becoming more common, having a reliable policy that covers flood damage is indispensable. It emphasizes that a standard homeowners’ insurance policy might not cover flood damage, highlighting the importance of obtaining a separate flood insurance policy to ensure full protection.

What flood insurance usually covers?

Understanding what does flood insurance cover is vital for homeowners and renters alike. Here are five key aspects usually covered by a flood insurance policy.

Structural damage

Flood insurance covers damage to the physical structure of your home. This includes the foundation, walls, and roof, ensuring that the main components of your home can be repaired or rebuilt.

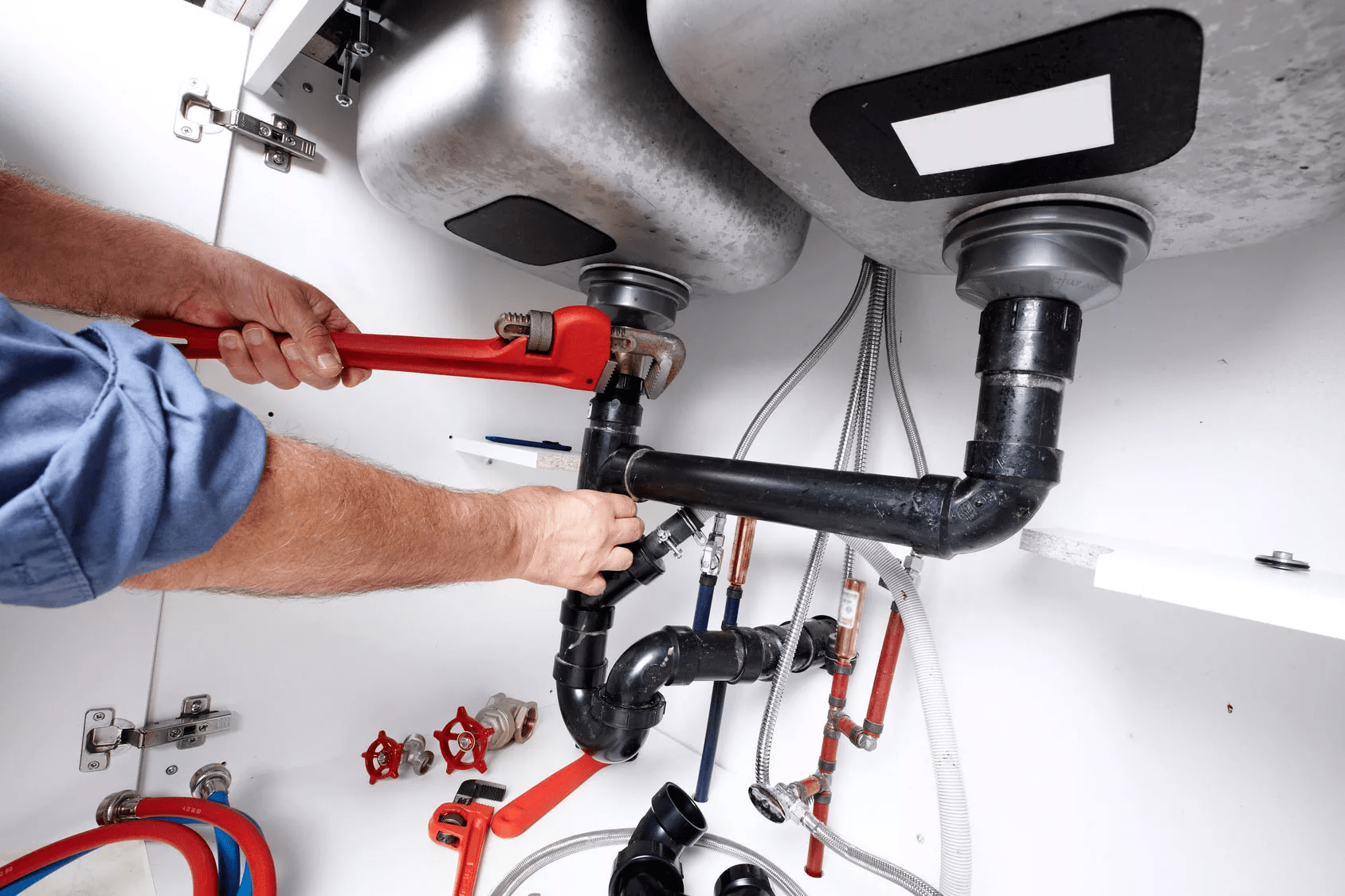

Electrical and plumbing systems

Flood insurance plays a crucial role in mitigating financial losses by covering repair costs for damaged electrical wiring and plumbing systems, essential for restoring a home’s functionality after flood-induced damage.

Personal property

Personal belongings such as furniture, electronics, and clothing can also be protected under flood insurance. This coverage helps you replace or repair items that have sentimental or high monetary value.

Appliances

Major appliances like refrigerators, washing machines, and dryers are often covered. Given their cost, having them included in your flood insurance policy can save you significant money.

Detached structures

Many policies extend coverage to structures not attached to your home, such as garages, sheds, and fences. This comprehensive coverage ensures that every part of your property is protected.

To sum up

Flood insurance is essential for safeguarding your house and financial security. With a plethora of services at your disposal, affordably priced flood insurance provides peace of mind against the unpredictable nature. Never forget that your goal should be to recover from a calamity with the least amount of financial hardship possible. Flood insurance offers that security for every homeowner or tenant, which makes it a priceless asset.